FREE WEBINAR

How to protect

yourself against

IRS audit

Thursday, May 2nd at 7pm EST

💡Payroll Mastery

💡Red flags that cause an IRS audit

💡How to win an audit against the IRS.

💡How to properly pay yourself from your business

💡How to put yourself on payroll through your business.

Learn bookkeeping strategies to save you thousands on taxes.

Unlock the Key to Business Success

Business Books

Discover LLC & S - Corp bookkeeping requirements by the IRS

Learn the process of Paying employees vs contractors

Important deadlines that can cost you if missed.

Payroll Mastery

Explore payroll software and technology tools to streamline payroll processes, improve accuracy, and ensure compliance.

ADDITIONAL TOPICS

💡Red flags that cause an IRS audit

💡How to win an audit against the IRS.

💡How to properly pay yourself from your business

💡How to put yourself on payroll through your business.

JOIN "THE QUEEN OF THE TAX CODE" FOR AN EXCLUSIVE LIVE EVENT THAT'LL HELP YOU REDUCE YOUR TAX BURDEN

LIVE ONLINE TRAINING

Thursday, May 2nd at 7pm EST

Secure Your Seat for the Exclusive Free Live Training!

Unlock the Secrets of Bookkeeping & Payroll - Join the Training Now!

Meet YOUR INSTRUCTOR

SHAQUANNA 'Ms. Business' BROOKS

For over a decade, I've been deeply entrenched in the realms of tax, finance, business formation, and consulting, serving as a Certified Public Accountant.

Guiding clients with a collective net worth exceeding 40 million dollars, I've steered them towards their business aspirations through strategic solutions, including business structure selection and mastering tax management. Yet, my commitment extends beyond mere service;

I firmly believe in empowering my clients through education.

Recognizing the widespread lack of financial literacy, I embarked on a mission to spread financial empowerment nationwide through speaking engagements, webinars, and tailored events.

The Ms. Business brand represents not just a service, but a commitment to educate and equip individuals with the tools for long-term success and generational wealth.

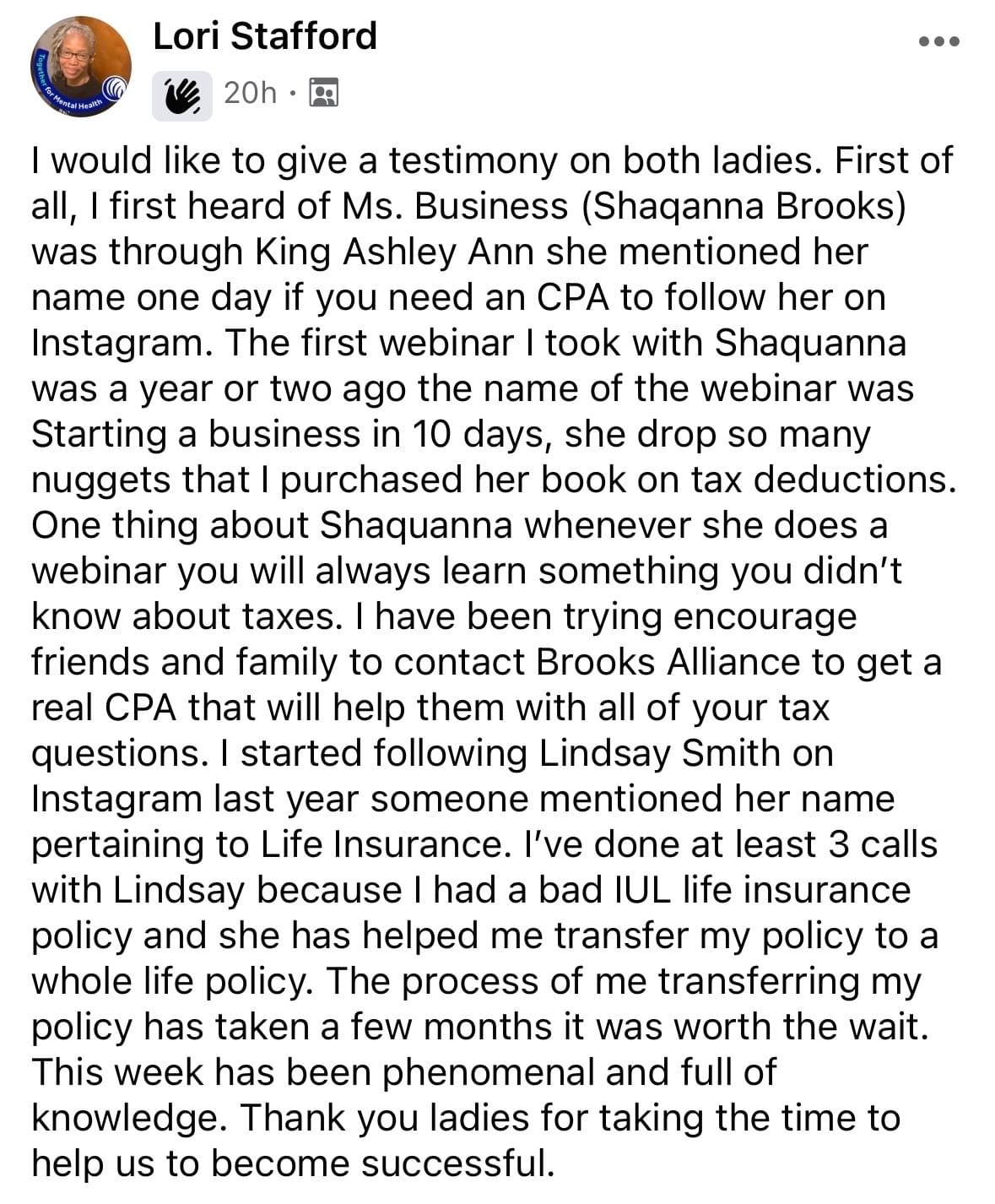

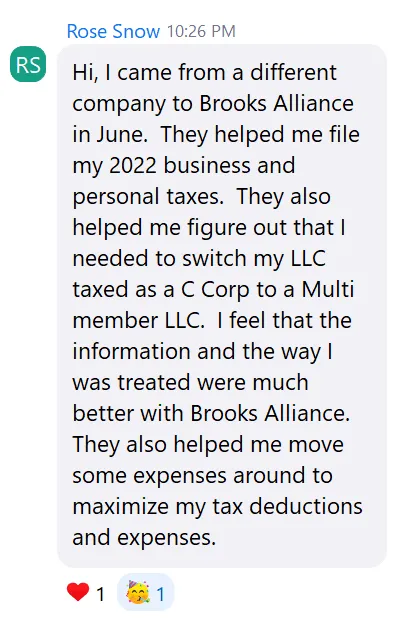

What Others Are Saying...

Sheryl Grant

Jasmine Anyakudo

Perris Turner

LaTashi Brooks

TITLE

TITLE

TITLE

All Rights Reserved | Ms.Business Inc. |Copyright 2024

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

The results you see are the results of specific clients. We do not guarantee you will receive any specific results. You could get better results, worse results, or the same results. We only guarantee that we will give you our tools & strategies to help you save money on taxes.

Contact [email protected] for assistance.